Living in the USA can be costly for a graduate student, but over the years, I have found that we can save some money using different strategies that I am going to share here. It’s always good to be financially smart and aware of the different credit card offers so that you can take advantage of the financial system when needed.

Credit cards: You need a credit card as soon as you join a university to build a credit history. Even if you think you are not responsible enough and might overspend, get a credit card with the lowest limit and use it only for automated bill payments like mobile bills, electricity and other utilities bills. And if you don’t think you can remember to pay your credit card bills, either put it on autopay or mark your calendar within one week of your last day of credit card payment. This will overtime build a credit history with a good payment record and will help you in the future if you apply for other kinds of loans line auto loan, house loan, etc.

Based on your need and credit record, you can choose between different types of credit cards with rewards like

- Cash rewards: you get cash back for your purchases ranging from 3-5 %. Some popular ones are discover IT, American express blue cash, bank of America cash rewards credit card, etc.

- Travel/hotel rewards credit cards: you get air miles which you can redeem towards travel. Some popular ones are Bank of America travel rewards, Amex blue delta credit card, Chase Southwest Card, Amex Hilton Honors card, etc.

- Retail rewards credit cards: you get extra cashback ( 10% or even more) when you purchase from that specific vendor ( like apple credit cards, amazon credit cards, etc)

getting your first card can be tricky, it is like you are fresh out of university and when you apply for a job, it requires experience but to get the experience you need a job.

Most of the credit card companies work similarly, they need a good credit score as well as the length of the credit period. I was rejected for some credit cards even though I had a good credit score stating that the length of my credit history was not sufficient enough.

So getting a new credit card for an international student can be tricky. Also, selecting a proper card can be confusing, so here are my 2 cents to it.

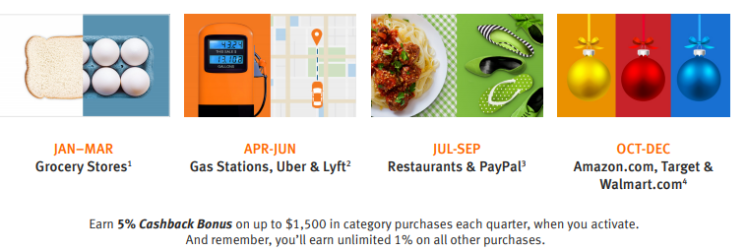

Start with a student credit card as soon as you have your SSN number with you. I applied for Discover IT students credit card and got approved instantly with around 1200$ credit limit which has increased over time. You get 50$ sign up credit bonus and if you perform well in your academics you get an extra 20$ at the end of the first year. I was also able to benefit it’s 5% cashback policy shown in the figure below to get decent cash back on my grocery purchases. Another good news, they matched my first year cashback total giving me an extra 200$ in cashback at the end of the first year.

Once you have your credit card and start building a credit history you can apply for better cards with good sign up rewards. My second card was AMEX delta gold card and I used the card to partially pay my university fee to qualify for the Airmiles (the offer when I signed up was 60000 Airmiles on spending 2000$ in the first three months). That is equivalent to 4 return airfares to JFK from Buffalo with other benefits like first checked-in bag free and 50$ statement credits. It’s an absolute win-win situation, you can partly pay your fees while collecting Airmiles for travel. Although it comes with annual fees of 95$ charged at the end of the first year, you can easily switch to a card with no annual fees and retain your Airmiles at the end of the first year or continue to use the card as it’s totally worth it. You can get an extra 10-15K Airmiles when you use your AMEX delta card to buy tickets to home using KLM-Air France and other partner airlines. The card has no foreign transaction fees, which means you can use it more frequently and save some extra bucks while you are traveling abroad.

If you have a Bank of America account, I would recommend trying their cash rewards or travel rewards cards (linked above). Apart from an exciting signup bonus ( you get 200$ on spending 1000$ in the first three months and no annual fee), you get an extra 10% bonus if you redeem the cashback bonus to your checking account. Which means you get 220$ after you spend 1000$ in the first 3 months of getting the card.

If you want to read more about credit cards, here are interesting blogs to read.

- https://thepointsguy.com/

- https://www.thesimpledollar.com/credit-cards/blog/

- https://blog.creditkarma.com/ ( I also recommend their app for credit score monitoring)

Remember, with great spending limit comes great responsibility. And you must get a card only if you have the ability for controlled spending, protecting your data and paying your credit card bills regularly.

(Note: the author is not a financial advisor and the post is just meant to share his views about responsible credit card usage and contains some affiliate links)

One thought on “Some money-saving tips for grad students in the USA (part 1: Credit cards)”